It’s a pretty simple story this week as the on-again, off-again tariffs have injected uncertainty into the markets and driven US stock indices lower. Overseas stocks, specifically European markets, have held up particularly well. February showed a sharp divergence between US S&P 500 (blue), US Nasdaq (green), and overseas (red) stocks.

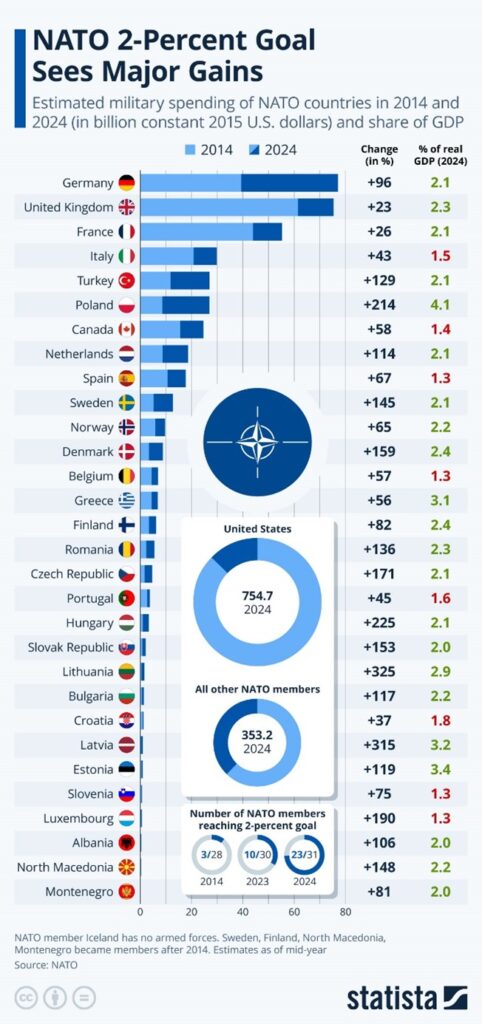

In response to the Trump administration’s attitude toward global trade and defense, several global leaders have responded with talks of “getting their house in order.” This includes a renewed focus by some on their domestic economy (as opposed to exports). European countries, such as Germany, are committing to spending more on defense, which is seen as an economic stimulus. In 2023, just 10 of NATOs 30 countries were spending 2% or more of their GDP on defense. Now, 23 of NATOs 31 countries are meeting the 2% goal.

There’s also some nervousness among global investors that US exceptionalism may have been overplayed. While the US economy and markets are certainly exceptional in many ways, the amount of capital drawn to US markets over recent years may have gone too far. The US has 4.2% of the world’s population and the US economy is roughly 26% of the global economy.

Yet, the US stock market now represents nearly 70% of the global stock market. That is to say, of all the money in the world invested in stocks, almost 70% of it is invested in US stocks.

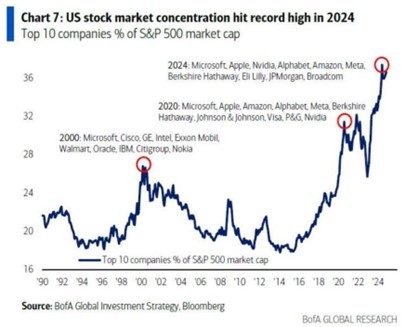

Some global investors are voicing concerns that they may have become overly-concentrated in the US markets. Adding to the uncertainty, the US stock market itself may be overly-concentrated in too few companies as 38% of the money in the US stock market is now invested in just 10 companies.

So it wouldn’t be unusual, or unhealthy, to see some of the money that’s become very concentrated in the US stock market to move to other attractive opportunities in US markets and abroad. It’s still too early to say this is the beginning of a bigger unwinding process, but it certainly brings the risks of concentration into focus and makes a good argument for diversification.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.