The Trump administration invoked the International Emergency Economic Powers Act (IEEPA) this week to address widening trade imbalances by imposing broad trade tariffs across the globe. While the founding fathers originally gave Congress the power to impose tariffs, over the past sixty years we’ve seen Congress turn more of those powers over to the executive branch.

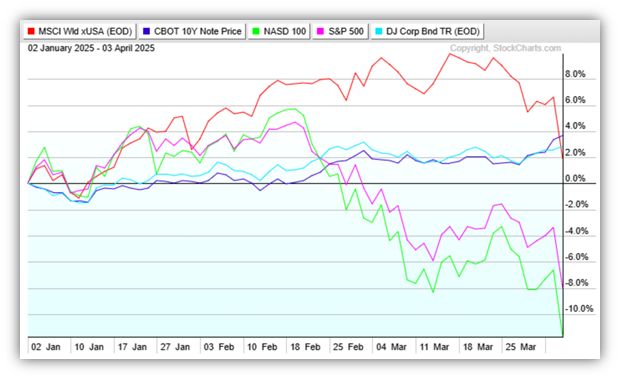

The tariffs were much higher than expected by the markets, sending stocks sharply lower this week. International stocks (red) remain positive year-to-date and government bonds (dark blue) and corporate bonds (light blue) are moving higher. However, the S&P 500 (pink) is down about -8% and the Nasdaq (green) is down roughly -12% as of market close on Thursday.

This stock market decline is natural as investors recalibrate their expectations for growth in light of the tariffs. But the magnitude of disruption to global markets by the tariffs is likely to lead to major unintended consequences. While some may be good, many won’t be.

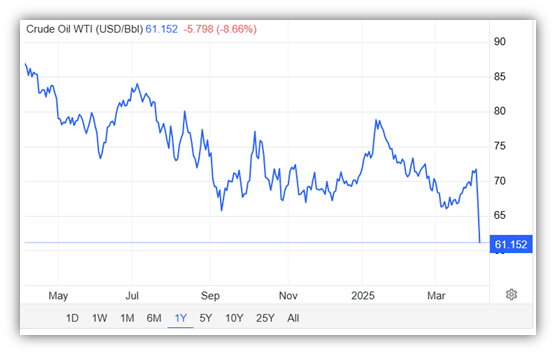

As stock prices have fallen this week, we’ve seen interest rates decline, oil prices collapse, and the US dollar weaken. Although they’ve occurred for unfortunate reasons, these declines could partially offset potentially higher prices to come.

https://tradingeconomics.com/commodity/crude-oil

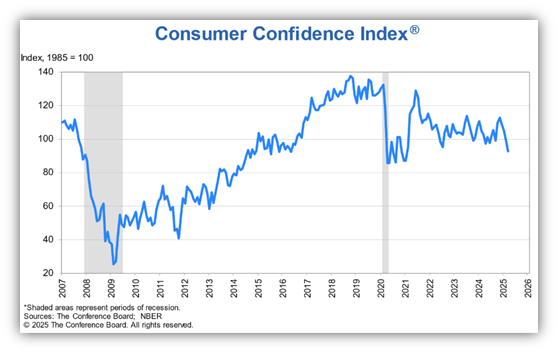

There’s no doubt that risk in the markets and global economy is rising. Prior to the announcement of these tariffs, “soft” data on the US economy was showing signs of weakness while the “hard” data was still strong. Soft data generally refers to sentiment surveys (how consumers feel) and consumer expectations. Hard data is more quantitative, such as the unemployment rate, inflation, and economic growth (GDP).

For example, consumer confidence has been declining this year and short-term inflation expectations have risen.

But today, the March jobs report was released and showed 228,000 jobs were created in March vs expectations of 140,000. The unemployment rate rose from 4.1% to 4.2% as more workers entered the job market.

The tariffs have now hung a cloud of uncertainty over the economy, causing many companies and consumers to freeze spending plans until there is more clarity. If this uncertainty hangs around too long, the weakness we were already seeing in the soft economic data will manifest itself in the hard data, leading us closer to a recession. Markets now expect the Fed to cut interest rates up to four times this year to counter a slowdown, but the Fed will now be flying blind with regards to inflation, unable to separate the effects of tariffs and demand on rising prices.

Now is the time to remember a well-diversified portfolio is designed to get through uncertainty and even recessions. Our proprietary risk model recommended an additional reduction in equity exposure for tactical strategies once again on March 31 and remains very defensive.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector.

The MSCI World ex USA Index captures large and mid-cap companies across 22 of 23 Developed Markets (DM) countries excluding the United States. With 985 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Dow Jones Corporate Bond Index is an equally weighted basket of 96 recently issued investment-grade corporate bonds with laddered maturities. The index intends to measure the return of readily tradable, high-grade U.S. corporate bonds. It is priced daily.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.