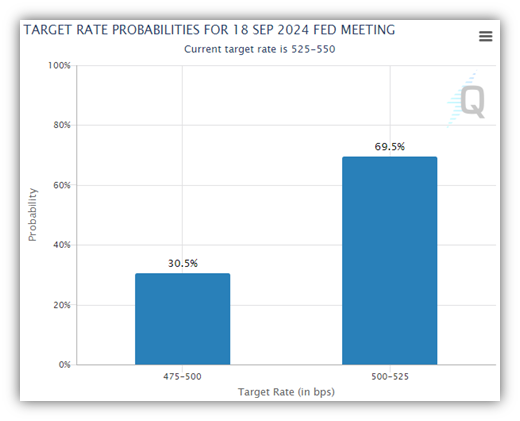

As of Friday morning, markets are finishing the month on a positive note. The Fed’s favorite inflation measure (PCE, or Personal Consumption Expenditures price index) for July 2024 was published today by the Bureau of Economic Analysis. It showed that prices increased 0.2% in July, which was in line with expectations. This makes it a near certainty the first Fed rate cut will come in September, with a 70% chance it will be a 0.25% cut, and a 30% chance of a 0.50% rate cut.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

If you’re in the business of retirement planning, you must make certain assumptions about the future behavior of the markets. Every year Horizon Actuarial Services, a pension fund consultant, conducts a survey to gather market forecasts from major financial firms. 41 companies participated this year and the results were published this month. The annual publications are available to the public and easy to read. The latest edition can be found here – https://www.horizonactuarial.com/survey-of-capital-market-assumptions

While some companies may be more optimistic, and others more pessimistic, the individual responses are kept confidential and only the averages are published. Here are some highlighted 10-year expected returns from this year’s publication –

Large US stocks: 6.46%

Non-US stocks (Developed countries): 7.08%

US Bonds (Core): 4.93%

Hedge Funds: 5.90%

Cash Equivalents: 3.68%

Inflation: 2.42%

It’s important to remember that these figures are just forecasts. No one has a crystal ball. However, as these figures represent the analysis performed by 41 major financial firms, we feel they provide a useful input to our retirement planning process. Specifically, we use them to ensure the forecasts we use from Raymond James are reasonable, and we’re happy to report they are.

We also find it interesting that combining the most popular investment asset classes of US large cap stocks and US bonds doesn’t give investors much variation in their forecasted returns.

40% US large cap stocks / 60% US Bonds = 5.54%

50% US large cap stocks / 50% US Bonds = 5.70%

60% US large cap stocks / 40% US Bonds = 5.85%

70% US large cap stocks / 30% US Bonds = 6.00%

80% US large cap stocks / 20% US Bonds = 6.15%

These combinations represent a wide range of risk, but a narrow range of expected returns. If these forecasts are close to being accurate, investors should consider broadening their investment mix beyond what has worked so well in the past decade.

Have a great holiday weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

Keep in mind that individuals cannot invest directly in any index. Past performance does not guarantee future results. Individual investors’ results will vary.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. International investing involves special risks, including currency fluctuations, differing accounting standards, and possible political volatility.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.