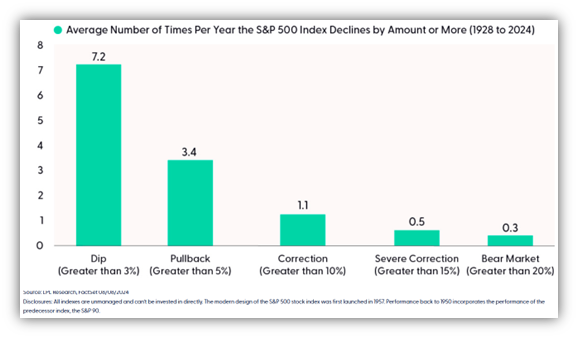

Tariffs and uncertainty pushed US stocks lower again this week and the S&P 500 is now officially in a correction, defined as a decline of 10% or greater. The index reached its all-time high on February 19th and has fallen a little over 10% since then. Going back to 1928 the stock market has experienced, on average, one such correction each year. A severe correction of 15% or more has occurred, on average, once every 2 years. A bear market, defined as a market decline of 20% or more, has typically occurred every 3 years.

Let’s look at why we’re even talking about tariffs. Here’s the problem the Trump administration is attempting to address.

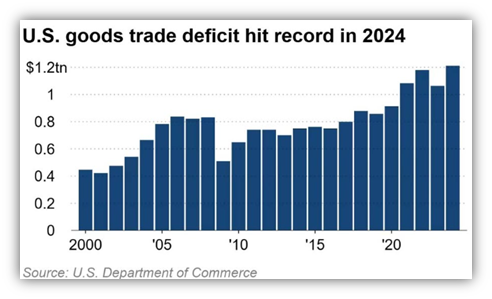

To put it simply, in 2024 American consumers spent $1.2 trillion more on other countries’ stuff than they spent on ours, an increase of 50% since 2017. That’s $1,200,000,000,000 that left the United States to create jobs and grow other countries’ economies.

The Trump administration is hoping to use tariffs to encourage Americans (through higher prices on imports), to buy more American goods, creating more jobs and growing the economy here instead. Just getting back to the 2017 trade deficit could create a $400 billion economic stimulus from current deficit levels. It could work, but it’s not very likely. These tariffs and reciprocal tariffs will cause economic pain on both sides of the trade, but the pain will no doubt be greater for our trading partners as their economies are more dependent on exports. However, many countries, such as Canada, are considering these tariffs an economic attack and are using them as an opportunity to unite against a common enemy, the US.

Our trading partners are counting on two things to prevail against the US. First, America is divided and won’t be able to come together to endure a hardship. In a crisis, they expect half of the country to support the leadership and the other half to blame them (rightly or wrongly) for the crisis. Secondly, Americans have become hyper pain averse – some would even say soft. In the face of even minor economic difficulties, other countries expect Americans to protest and petition the government for relief. After all, in the past our government has been more than willing to accommodate the voters, as demonstrated by our rapidly growing $36 trillion national debt.

We’ll have to wait and see if the American people, and the Trump administration, are willing to leave the tariffs in place long enough to potentially be beneficial in the long term.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.