US stocks were looking to break a four-week losing streak today, but as I write this on Friday morning, it’s looking a little iffy. Investors remain nervous over two big events on the near-term horizon – 1) reciprocal tariffs going into effect on April 2nd, and 2) 1st quarter earnings announcements soon after April 2nd.

Bloomberg had this to say regarding US stocks this week –

“Stocks may come under increasing pressure this year, as policy prerogatives amplify the rotation away from early-cycle winners to new leadership. Cycle recovery may continue to spread to unloved corners of the US equity market, as long as a consumer-led recession is avoided and the Federal Reserve stays onboard with easing.”

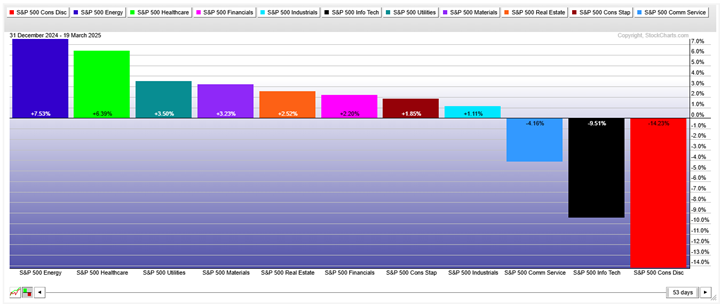

When they mention a “rotation away from early-cycle winners to new leadership,” they’re simply saying that sectors that worked well last year (consumer discretionary and technology) are now being replaced with sectors that were lagging (healthcare, energy, utilities). As such, this year’s market activity so far looks more like a rotation than the beginning of a significant decline.

The Fed met this week and announced no changes to interest rates, as expected. They also left their expectations of two rate cuts before the end of the year unchanged, which is consistent with market forecasts. All in all, not much new from the Fed this week.

Finally, discussions around tariffs and inflation have promoted an apparent paradox in the media – tariffs will result in higher prices, but tariffs won’t cause inflation. On the surface, this may not make sense. After all, doesn’t inflation mean higher prices? Yes and no. We measure inflation as the RATE at which prices rise. Those who claim that tariffs will not cause inflation generally admit they will result in a ONE-TIME price adjustment, but tariffs wouldn’t necessarily begin an accelerating TREND of higher prices. This makes sense in principle, but we’ll just have to wait and see what happens in practice if the Trump administration goes through with the April 2nd tariffs.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.