US stock indices spiked higher on Monday, but are looking to finish the week lower (as of Friday morning). Monday was a sign that investors are looking for patches of blue sky, but clouds of uncertainty remain in the forecast.

We received a lot of economic data for the month of February this morning. Most importantly, the Fed’s favorite measure of inflation, core personal consumption expenditures (core PCE), showed that the inflation rate was a little higher than expected at 2.8%. Additionally, consumer spending accelerated 0.4% last month, slightly below the forecast of 0.5%. However, personal income rose 0.8%, which was much higher than the expected 0.4%.

https://www.cnbc.com/2025/03/28/pce-inflation-february-2025-.html

So, with all the negative press about the US economy lately, let’s go back to the fundamentals – the key data we use to assess the condition of any economy.

Real GDP 2.5% (4th quarter)

Unemployment rate 4.1% (February)

Interest rates 4.33% (Fed rate)

Inflation rate 2.8% (core PCE)

These are very good numbers for the largest economy in the world. Plus, the US stock market has far outperformed overseas markets for the past 15 years, and is now about 8% below its all-time high reached on February 19th. This decline reflects increasing uncertainty about the future.

There is always uncertainty, but now the range of potential outcomes is getting much wider. And while it’s impossible to predict short-term outcomes in markets and economies with any certainty, there is one group of people who forge ahead with unbridled confidence anyway – economists.

I’m always amazed at the confidence with which so many economists talk about the future. Don’t get me wrong, I think they can do a great job explaining why things happened in the past, but their track record isn’t so great when attempting to understand the present or forecast the future.

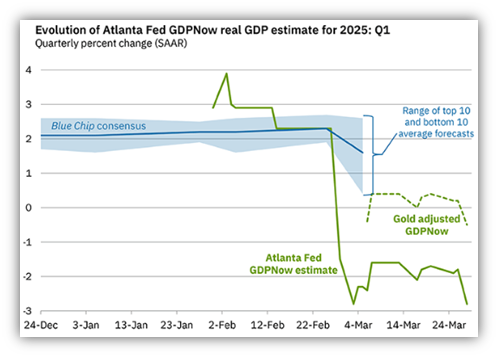

Here’s a good example.

Economists at the Atlanta Fed have models that attempt to understand real-time economic date in order to predict US economic growth (GDP) for the current quarter. Currently, the Atlanta Fed economists are forecasting -2.8% real GDP “growth” for this quarter.

https://www.atlantafed.org/cqer/research/gdpnow.aspx

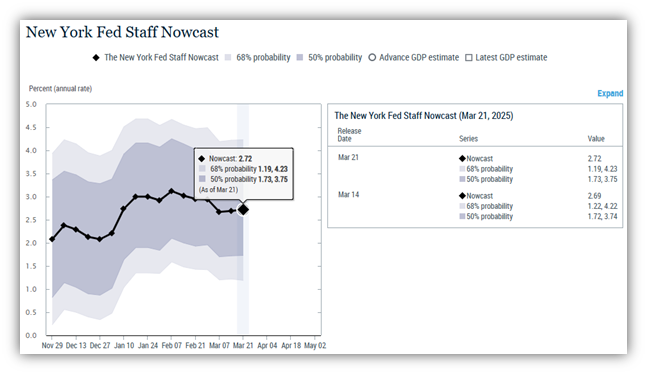

This is a terrible number. If the possibility of an economic contraction makes you uncomfortable, I suggest you focus your attention on the economists at the New York Fed.

https://www.newyorkfed.org/research/policy/nowcast#/nowcast

2.72% GDP growth is much better. So it’s now clear that, according to some highly respected economists with the Fed, the US economy is growing at a rate somewhere between -2.8% and +2.7%.

Now I’m not picking on economists merely for entertainment purposes. I’m concerned when I hear investors using the predictions and forecasts of economists to potentially alter their investment plan, or making other important decisions. If you were considering investing in internet companies in the 1990s, or artificial intelligence now, Nobel Prize-winning economist Paul Krugman has been offering his investment advice.

Economies and markets are incredibly complex and made even more unpredictable by the effects of human emotions. We should be humble in our inability to predict the future and be wise in adopting an investment plan that is prepared for a wide range of potential outcomes.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.