US citizens elected to send Donald Trump back to the White House for another 4 years this week. He will have a Republican Senate with him for at least 2 years, and possibly a Republican House of Representatives as well.

It can be tempting to read the tea leaves and pick sectors or companies that are expected to outperform under a new administration, but history has shown that the markets aren’t that simple. We only need to look back to Trump’s first term to see a clear example. After his surprise election in 2016 it was energy stocks that were picked to do well under his administration – “Drill baby drill!” Big tech companies were expected to be under pressure as investors feared they would suffer under President Trump’s scrutiny.

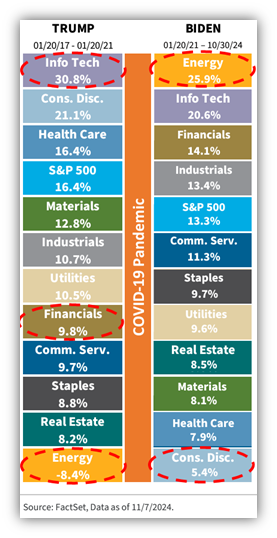

As you can see, energy stocks were the only negative sector under Trump’s first term while tech companies led the market. Then, after President Biden was elected, the mood turned sour for the energy sector as President Biden’s campaign promoted a green energy transformation. Consumer discretionary stocks were picked as likely winners under a Biden administration as consumers were being showered with covid stimulus and encouraged to spend to support the economy. Again, just the opposite was true under his administration as energy has outperformed even red-hot tech companies while the consumer discretionary sector is in last place.

While leadership in Washington is clearly a factor in the performance of the economy and the markets, there are many more variables at work that make forecasting winners and losers very difficult.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.