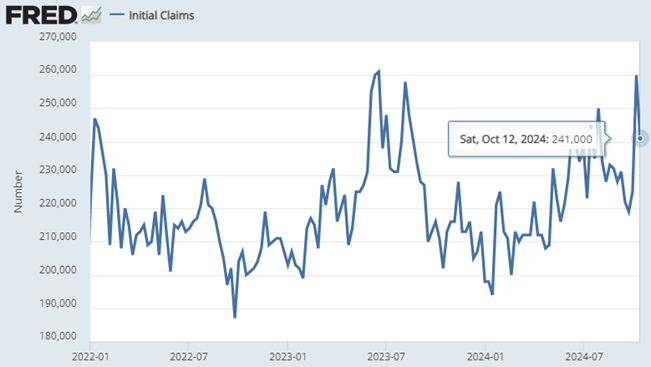

Major US stock indices remain near their all-time highs this month. So far in October, US stocks are slightly higher, while bonds and international stocks are slightly lower. Economic news remains positive. Unemployment claims fell back to 241,000 this week after unexpectedly spiking to 260,000 last week.

Retail sales were stronger than expected in September, coming in at a 0.4% increase versus a 0.3% gain expected by economists polled by the Wall Street Journal.

https://www.marketwatch.com/story/retail-sales-post-solid-gain-in-september-9671f5f6

As we approach national elections in November, markets typically begin betting on winners and losers in the weeks leading up to the vote. Well-known hedge fund investor Stanley Druckenmiller said this week that, while he could not see himself voting for either presidential candidate, the market is “very convinced” of an election victory for former President Trump.

“I must say, in the last 12 days, the market and the inside of the market, is very convinced Trump is going to win,” Druckenmiller said in an interview with Bloomberg Television’s Sonali Basak. “You can see it in the bank stocks, you can see it in crypto, you can even see it in DJT, his social media company.”

https://thehill.com/business/4937965-billionaire-investor-market-trump-victory/

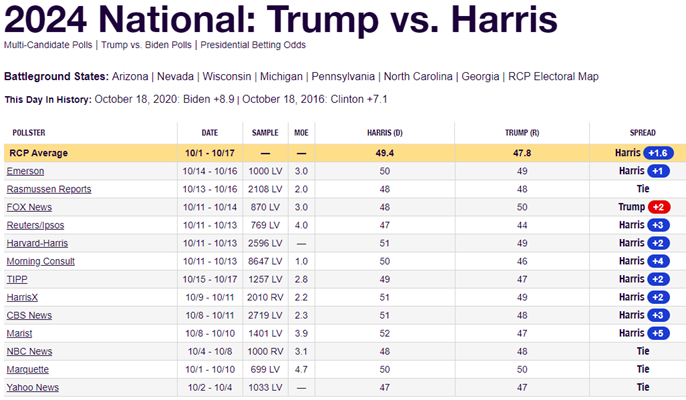

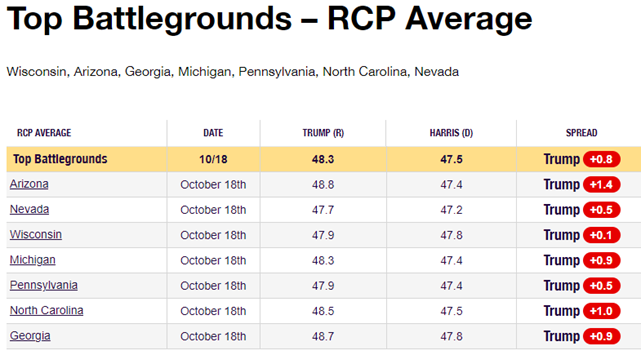

Polls are still showing the election as a dead-heat. With the “Trump trade” in effect, markets may be counting on the polls to get it wrong again this year, just like they were in 2016 and 2020. In both of those presidential elections Trump performed much better than polls had predicted. This is a risky bet for those investing in the Trump trade as pollsters are constantly modifying their methodologies to make more accurate predictions. And who is to say the polls aren’t underestimating Vice President Harris’ support this time?

https://www.realclearpolling.com/polls/president/general/2024/trump-vs-harris

https://www.realclearpolling.com/elections/president/2024/battleground-states

Looking back across the past 30 presidential elections, whenever the Dow’s year-to-date gain as of Oct. 15 was greater than 10%, the incumbent party won 78% of the time. A good stock market has been good for the party in power. This year, the Dow indicator is currently placing the odds of a Harris victory at 72%.

But wait, there’s more. The electronic futures market is currently placing a 43% chance of a Harris victory. But electronic futures markets are a relatively new thing, so it’s difficult for their track records to be statistically significant.

While it appears the results of the upcoming election are as clear as mud, one thing is clear. It is likely to be a very close election and every vote will be important. Regardless of who you support, make sure you get out and vote.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal.

The MSCI Emerging Markets Index captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,328 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.