More good news for the US economy this week as the Fed’s favorite inflation measure (PCE Price Index) showed that inflation has fallen to 2.2% according to this indicator. Economists surveyed by Dow Jones had been expecting PCE to rise 2.3% from a year ago. Additionally, weekly unemployment claims came in at 218,000 and have been declining since they climbed to 250,000 at the end of July.

Many stock indices continued to rise this week to new all-time highs, except for US small companies. Most recently, small companies have lagged the market as massive amounts of capital have flowed into a handful of large technology companies. This isn’t just a recent phenomenon as large stocks have outperformed small stocks for over 20 years now. However, small company stocks are supposed to outperform large companies over time according to famous research done in 1992.

Award-winning researchers showed that US small cap stocks outperformed large stocks from 1963 – 1990 and they proposed that, since small stocks are riskier, they reward investors with extra returns. This makes sense, but where did the small company outperformance go in the past couple of decades? There’s good evidence showing the private markets have gobbled up the most attractive investment opportunities formerly found in the small cap public market.

Over a similar period, private markets have grown from under $1 trillion in 2002 (6% of the size of the US economy, or GDP) to over $10 trillion today (36% of GDP). Fast-growing small companies looking for capital to grow no longer need to deal with the heavy regulations associated with being a public company. They can stay private longer with investments coming from private equity firms.

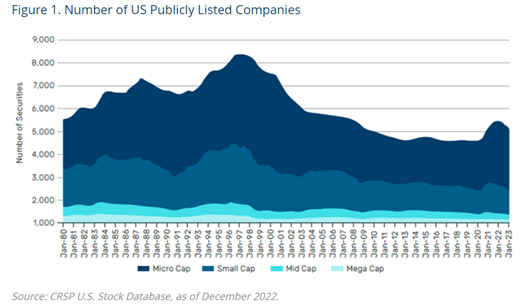

This is evidenced by the shrinking number of companies in the public stock market. In 1998 the number of companies in the public markets peaked at over 8,000. Today that number is around 5,000 and it’s the number of small companies that has shrunk the most.

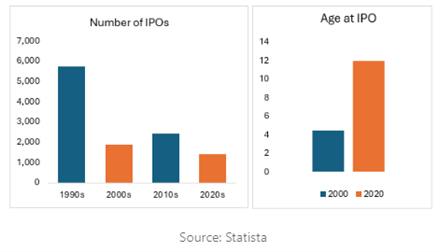

This is why we have fewer IPOs today, and when a company does go public it’s generally older. This means the years of a company’s most rapid growth have already occurred while it was backed by the private markets.

So, while increasing government regulation has worked to make the public markets safer for investors, it has inadvertently created better opportunities for the private markets that remain largely inaccessible to the general investing public today.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.