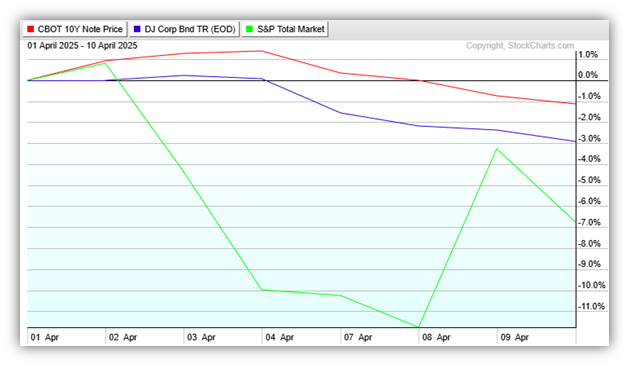

Markets were turbulent this week as tariffs remained front and center, dominating investment discussions. Bonds, typically a safe haven in times of market trouble, are down a little this month and continuing their recent pattern of bad behavior. Even Larry Fink, CEO of Blackrock, the largest money manager in the world with over $9 trillion under management, said Friday morning that he was shocked at this week’s move in the bond markets. Keep in mind, bonds are not down a lot, but the surprise is they are down at all in this environment. US treasuries are red, corporate bonds are blue, and US stocks are green.

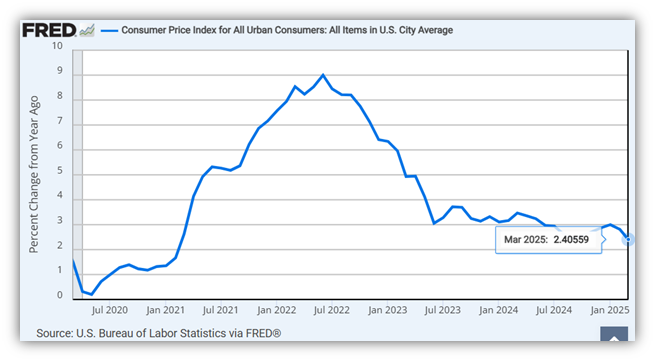

There was good economic news this week that was overshadowed by tariffs as March consumer prices fell 0.1%, lowering the inflation rate from 2.8% in February to 2.4%.

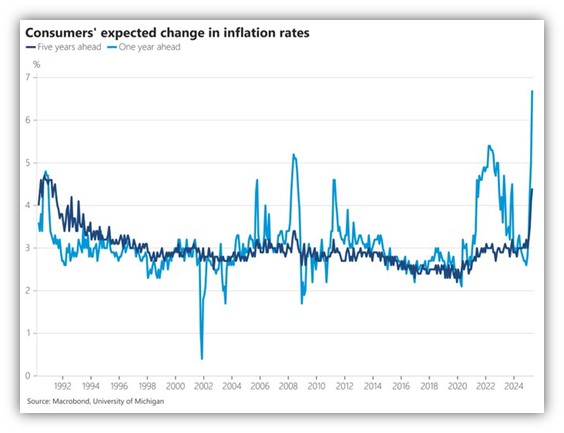

Additionally, oil prices have fallen from $71 per barrel at the end of March to around $60 today. This downward trend in prices could be beneficial in offsetting some potential price increases due to tariffs. According to the University of Michigan, American consumers are already bracing for higher prices as one-year inflation expectations have spiked to 6.7%.

We’ve never seen short-term inflation expectations this high, so it sets up an interesting question. Will consumers accelerate purchases ahead of higher anticipated prices, or will they postpone purchases altogether due to increased uncertainty? If the first option prevails, then we could see upside surprises in the economy. If the second option prevails (as looks to be more likely), then we run the risk of slipping into a recession. Either way, we should expect continued volatility in the markets until some of this uncertainty gets resolved.

Have a great weekend.

Jack C. Harmon II, CFP®, CIMA

Principal, Harmon Financial Advisors

Registered Principal, Raymond James Financial Services

Harmon Financial Advisors, Inc. is an independent, fee-based financial planning firm and an independent Registered Investment Advisor. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. and Harmon Financial Advisors, Inc. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Harmon Financial Advisors, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services, Inc.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information in this commercial email has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Harmon Financial Advisors, Inc. and not necessarily those of RJFS or Raymond James.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P Total Market Index (TMI) is designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

The Dow Jones Corporate Bond Index is an equally weighted basket of 96 recently issued investment-grade corporate bonds with laddered maturities. The index intends to measure the return of readily tradable, high-grade U.S. corporate bonds. It is priced daily.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CIMA” and “Certified Investment Management Analyst.” Use of CIMA and/or Certified Investment Management Analyst signifies that the user has successfully completed The Institute’s initial and ongoing credentialing requirements for investment management professionals.